📈 How to Trade Market Gaps: Strategies, Types, and Common Mistakes

Did you know that the famous “Black Monday” crash of 1987 began with a 10% overnight gap that trapped thousands of traders? I remember my first encounter with a gap – I woke up to find my stop loss hadn’t protected me at all. The market had simply leaped over it like a hurdler, teaching me a brutal lesson about gap trading the hard way.

In this eye-opening guide, you’ll discover:

✅ The 4 types of market gaps every trader must know

✅ How to tell dangerous gaps from profitable opportunities

✅ Why most retail traders get gaps completely wrong

✅ How to use gaps to spot institutional activity

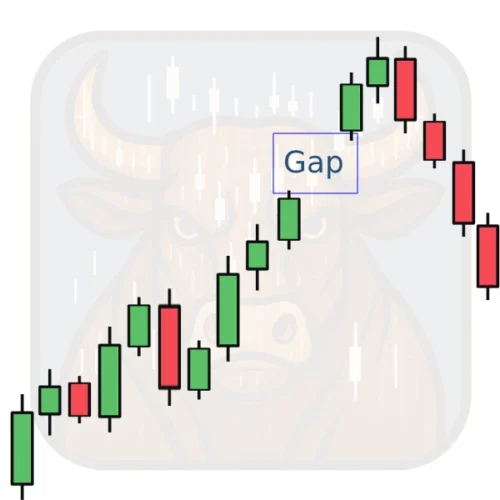

💡 What is a Market Gap?

A market gap occurs when an asset’s price opens significantly higher or lower than its previous close, creating a “gap” on the price chart. These typically happen when:

- Major news breaks after hours

- Earnings reports surprise investors

- Economic data shocks the market

- Overnight sentiment shifts dramatically

📌 Key Characteristics:

- Shows as a blank space on candlestick/bar charts

- Represents instant repricing by the market

- Occurs across all markets (stocks, forex, crypto)

Why Gaps Matter:

✔ Reveal powerful shifts in supply/demand

✔ Create risk/reward opportunities

✔ Show where liquidity is lacking

✔ Often act as future support/resistance

🧩 The 4 Types of Market Gaps (With Examples)

1️⃣ Common Gaps

- Small, frequent gaps in quiet markets

- Usually fill quickly (price returns to pre-gap levels)

- Example: A stock gapping $0.10 on low volume

2️⃣ Breakaway Gaps

- Signal start of new trends

- Occur after consolidation patterns

- Example: Bitcoin breaking $20,000 in 2020

3️⃣ Runaway (Measuring) Gaps

- Mid-trend acceleration

- Indicate strong continuation

- Example: Tesla during 2020 rally

4️⃣ Exhaustion Gaps

- Final push before reversals

- Often see massive volume

- Example: GameStop January 2021 peak

💡 Pro Tip: I keep a screenshot album of textbook gaps – it’s helped me recognize patterns faster.

📊 How to Identify & Trade Gaps

The Gap Filling Strategy (For Common Gaps)

- Identify a common gap (small, no major news)

- Wait for price to start returning

- Enter in the fill direction

- Target 50-100% of gap fill

Breakaway Gap Strategy

- Confirm high volume + catalyst

- Enter on pullback to gap edge

- Ride the new trend

⚠️ Danger Zone: Never assume all gaps must fill – this myth has wiped out many accounts!

🔍 Reading the Gap Tea Leaves

| Gap Type | Volume | Likelihood to Fill | Trading Approach |

|---|---|---|---|

| Common | Low | High | Fade the gap |

| Breakaway | High | Low | Follow momentum |

| Runaway | Medium | 50/50 | Trend continuation |

| Exhaustion | Very High | High likelihood to fill, but timing can vary | Prepare to reverse |

“My biggest win came from recognizing a breakaway gap in NVIDIA before its AI boom – the gap never filled and became launchpad for 300% gains.”

⚠️ Gap Trading for Beginners: 5 Costly Gap Trading Mistakes

❌ Trading against breakaway gaps (The “it must fill” fallacy)

❌ Ignoring volume clues (Low-volume gaps often fill)

❌ Using tight stops (Gaps create volatility expansions)

❌ Overlooking the context (Gap after earnings ≠ technical gap)

❌ Forgetting about liquidity (Gaps widen during thin markets)

📈 Gap Analysis by Market

Stocks

- Most gaps occur at market open

- Earnings gaps are predictable (use options strategies)

- Dividend gaps are mechanical (price drops by dividend amount)

Forex

- Gaps mainly appear over weekends

- Sunday opens often “fill” by Monday noon

- Major news gaps (ECB, Fed) may never fill

Crypto

- Gaps occur 24/7 but less pronounced

- Exchange-specific gaps happen

- Whale activity creates “fake” gaps

💡 Fun Fact: The S&P 500 has gapped nearly 60% of trading days in 2024 so far!

❓ Gap Trading FAQs

No – breakaway gaps often become permanent new support/resistance.

Daily charts for analysis, 1H/4H for entries.

Use options (for stocks) or avoid holding over high-risk events.

Some (like earnings) are anticipated, but most are surprises.

“Stop-limit” orders prevent worst slippage.

📌 Key Takeaways

✔ Gaps reveal instant repricing by the market

✔ There are 4 distinct gap types requiring different strategies

✔ Volume determines gap significance

✔ Not all gaps must fill (dangerous myth)

✔ Each market gaps differently

🚀 Your Gap Trading Action Plan

- Start a Gap Journal (Screenshot and categorize gaps)

- Paper Trade the strategies above

- Master One Market (Stocks are most beginner-friendly)

- Add Gap Analysis to your routine

Now you’re equipped to trade gaps like the institutions do! 📊💹

Recommended Reading

Guide to Volume Price Analysis by Anna Coulling

Technical Analysis of the Financial Markets by John J. Murphy