📊 Market Psychology Unveiled

🔍 Introduction: The Market’s Emotional Thermometer

Sentiment analysis studies collective emotions and opinions that influence financial markets. Unlike technical analysis (charts) or fundamental analysis (economic data), it measures fear, greed, and expectations among investors using tools like AI, social media, and news. It’s key to anticipating sharp movements, such as those caused by short squeezes or sudden panics.

🔍 1. What Is Sentiment Analysis?

It gauges the market’s emotional state to predict movements based on crowd psychology:

- Excessive optimism → Potential market top

- Extreme fear → Potential buying opportunity

Key stat: 90% of trading decisions have an emotional component (Dalbar Associates study).

📊 2. Key Sentiment Indicators

A. VIX Index (Fear Gauge)

- Measures expected volatility in the S&P 500

- >30: Extreme fear (buying opportunity)

- <15: Complacency (caution advised)

Real example: March 2020 – VIX hit 82.69 (all-time high).

B. Sentiment Surveys

- AAII Investor Sentiment Survey:

- % of bullish vs. bearish investors

- Contrarian signal when extremes >60%

- Put/Call Ratio:

- PUT (protective) vs. CALL (bullish) options volume

- Ratio >1 = Predominant fear

C. Money Flows

- ETF Flows: Massive capital inflows/outflows

- Margin Debt: Increase = Leverage/overconfidence

💻 3. Digital Sentiment Tools

| Tool | Measures | Practical Use |

|---|---|---|

| StockTwits | Mention volume/emoji usage | Spot trending stocks |

| Google Trends | Financial search trends | Spikes = mass interest |

| HedgeTrack | Hedge fund positions | Track “smart money” |

| LunarCrush | Crypto social activity | Viral altcoins |

Case study: Jan 2021 – GME on Reddit:

- Mentions surged +2,500%

- Short interest >140%

- Result: +1,700% in weeks

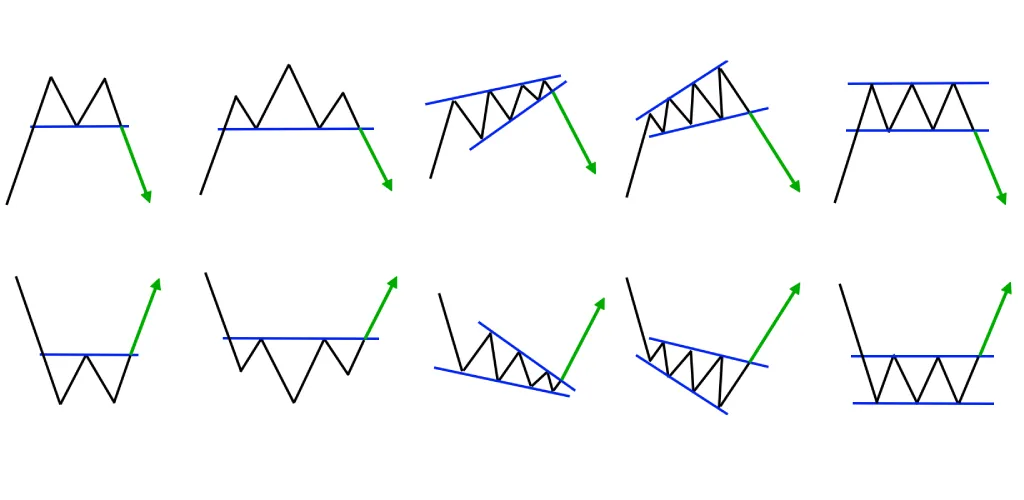

📈 4. Sentiment-Based Strategies

A. Contrarian Trading

- Buy during extreme fear (CNN Fear & Greed ≤20)

- Sell during extreme greed (index ≥80)

Stat: S&P 500 averages +15% returns when Fear & Greed <25 (12 months later).

B. Event-Driven Sentiment

- Earnings Calls:

- Analyze CEO language (positive/negative)

- Guidance changes

- Macro News:

- Reactions to Fed data

- Keywords: “recession,” “recovery”

Example:

- “Inflation” in 2022 Fed reports → 0.73 correlation with volatility

🧠 5. Trading Psychology

Common biases:

- Confirmation: Seeking info that supports our beliefs

- Loss aversion: Losses hurt 2x more than gains

- Herd mentality: Following crowds (FOMO)

How to combat them:

- Pre-trade checklists

- Trade journaling

- Strategy automation

🌐 6. Real-Time Data Sources

- Bloomberg Terminal (professional)

- TradingView Social (free)

- Social Analytics (for crypto)

- SEC Edgar (institutional filings)

Pro tip: Create a “sentiment dashboard” with:

- 1 technical indicator (RSI)

- 1 flow indicator (ETFs)

- 1 social source (StockTwits)

⚠️ 7. Risks and Limitations

- Manipulation: Pump & dumps on social media

- Lag: Social data = delayed reactions

- Overload: Too many conflicting signals

Ideal solution: Combine with:

- 30% Technical analysis

- 30% Fundamental analysis

- 40% Sentiment analysis

📱 8. Case Study: Bitcoin 2024

- On-chain data:

- Holders accumulating (Glassnode)

- Social media:

- “Halving” = Most-mentioned term

- Surveys:

- 68% bullish (caution advised)

- Flows:

- Bitcoin ETF approvals = +$4B inflows

Strategy: Wait for pullback when:

- RSI >70 + Peak mentions + Massive inflows

📚 9. Recommended Books

- The Psychology of Money – Morgan Housel

- Contrarian Investment Strategies – David Dreman

- Market Mind Games – Denise Shull

Practical exercise:

- Pick a stock/crypto

- Check TradingView/StockTwits

- Identify:

- Recurring keywords

- Positive/negative ratio

- Sharp changes (last 7 days)

“So now that you’re armed with all the basics, it’s time for the big question – are you destined to be an investor or a trader? Don’t miss my next post where I’ll help you decide: (Short Class 5: Trader or Investor? How to Choose Your Perfect Market Role