**📊Trader vs Investor: What’s the Best Strategy for YOU?

Are you a fast-paced trader or a patient investor?

In this ultimate showdown, we’ll break down the key differences between trading and investing so you can discover which strategy aligns best with your personality, goals, and lifestyle.

🍎 What Is a Trader?

Think of the financial market (stocks, crypto, forex) as a fast-moving fruit market. Traders are like quick-thinking merchants—they buy low and sell high within a short time frame: minutes, hours, or days.

🧠 What Does a Trader Do?

A trader profits from short-term price movements by frequently entering and exiting the market. They rely on technical analysis, market news, and precise timing.

Simple Example:

- Buy: You see Apple stock at $150 today.

- Sell: By 3 PM, it rises to $155 and you sell.

- Profit: You made $5 per share in just hours! 🎉

But the market can swing both ways. If the stock drops to $145, you lose $5. 😬

Types of Traders:

- Day Trader: Opens and closes trades the same day. No overnight risk.

- Swing Trader: Holds trades for days or weeks.

- Scalper: Executes dozens of small trades within minutes, aiming for tiny but frequent profits.

🌳 What Is an Investor?

Now imagine the market as a peaceful orchard. Investors are like patient farmers—they plant seeds (buy assets) and let them grow for years, even decades, before harvesting profits. 🌱➡️🌳➡️🍎

🧠 What Does an Investor Do?

An investor buys and holds stocks, ETFs, real estate, or other assets, believing they’ll increase in value over time. They care less about daily price swings and more about the long-term growth potential.

Simple Example:

- Buy: You buy 1 Coca-Cola share at $50 (believing in the company’s growth).

- Wait: After 5 years, that share is worth $100.

- Profit: You doubled your money! 💰

Bonus: Many companies also pay dividends—a share of profits paid to shareholders regularly, like getting rent for owning stock.

Types of Investors:

- Passive: Invests in index funds/ETFs (diversifies easily).

- Active: Picks individual stocks (e.g., Apple, Tesla) after research.

- Dividend-Focused: Targets companies paying regular dividends.

🤔 Trading vs Investing: Which Is Right for You?

1. Time Commitment

🔹 Are you patient or do you prefer quick action?

- Trader: Like a “merchant” of assets. Trades in short timeframes (minutes to weeks). Requires daily market attention.

- Investor: Like an “owner” of businesses. Holds for years. Doesn’t need constant monitoring.

2. Risk & Stress

🔹 Can you handle stress or do you prefer calm?

- Trader: Higher short-term risk due to volatility. Potential for quick wins/losses. Requires emotional control.

- Investor: Less daily stress. Risk decreases over time but requires patience.

3. Knowledge Needed

🔹 Do you enjoy studying charts/news or researching solid companies?

- Trader: Needs technical analysis (charts, trends) and market news awareness.

- Investor: Focuses on fundamentals analysis (long-term company strength).

4. Starting Capital

🔹 Do you have small capital or can you commit long-term?

- Trader: Can start small, but frequent trades may rack up fees.

- Investor: Can start small and add gradually (e.g., monthly buys).

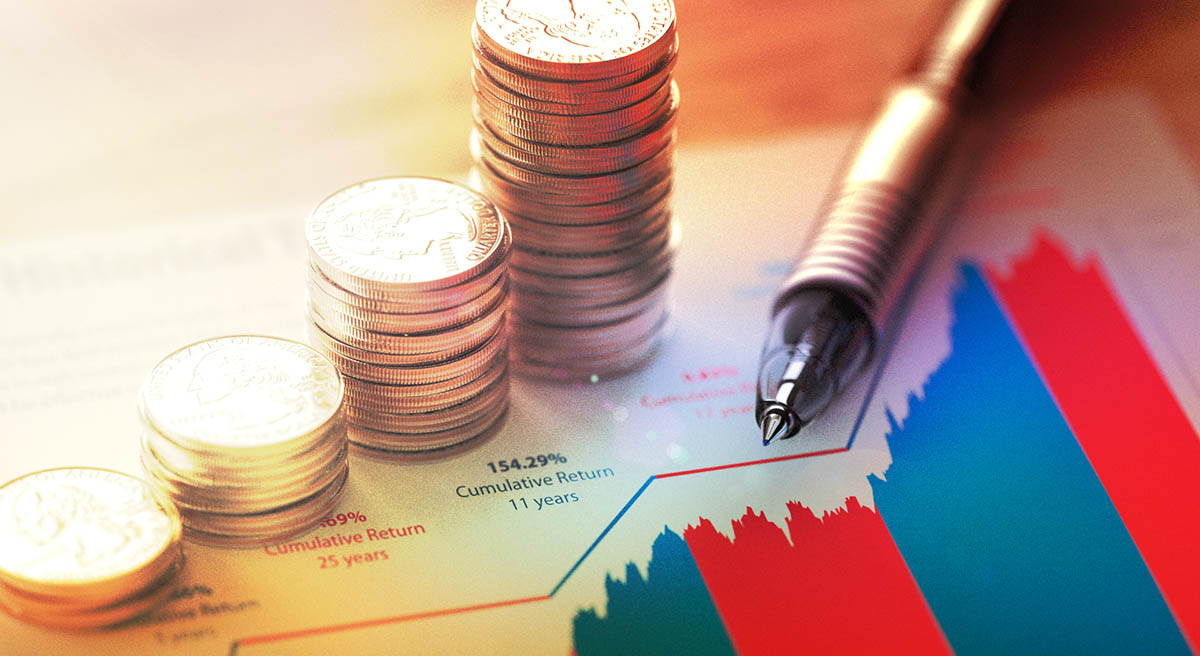

5. Expected Results

🔹 What are your goals?

- Trader: Quick profits (or losses). Depends on skill/discipline.

- Investor: Slower but steadier growth (e.g., 8%-12% average annual returns).

🎯 Should You Be a Trader or an Investor?

✅ Choose TRADING if…

- You enjoy fast-paced decision-making.

- You have time to monitor charts and market news.

- You’re comfortable with higher risk for potentially higher rewards.

✅ Choose INVESTING if…

- You prefer a long-term, lower-stress strategy.

- You don’t want to monitor the market daily.

- You want to build wealth gradually with compound growth and dividends.

💡 Pro Tip: Start as an Investor, Then Explore Trading

If you’re new to finance, start with investing to build a solid foundation. Once you’re comfortable and understand how markets work, explore trading with a small amount to see if it suits you.

🏁 Final Thoughts

Congratulations and thank you for making it this far! I hope these posts have helped you understand what this world is about and given you clarity about which trading/investing profile suits you best.

But of course, this isn’t the end of the journey there’s still so much more to learn (this was just the basics!). My ultimate goal in creating this website is to:

Re-study everything I know (to sharpen my skills),

Explore concepts I haven’t mastered yet (and share them with you and keep growing).

Recommended Reading

Guide to Volume Price Analysis by Anna Coulling

Technical Analysis of the Financial Markets by John J. Murphy