📈 What is ADX (Average Directional Index)? The Complete Trend Strength Guide

Did you know most traders can’t tell the difference between a real trend and fakeout? That’s exactly why J. Welles Wilder created the ADX indicator in 1978 – and what saved me from a 30% account blowup during last year’s choppy markets.

In this no-fluff guide, you’ll discover:

✅ What ADX really measures (most beginners get this wrong)

✅ How to read ADX values like a hedge fund trader

✅ 3 professional ADX trading strategies

✅ My ADX settings for day trading vs investing

🔍 What is the Average Directional Index (ADX)?

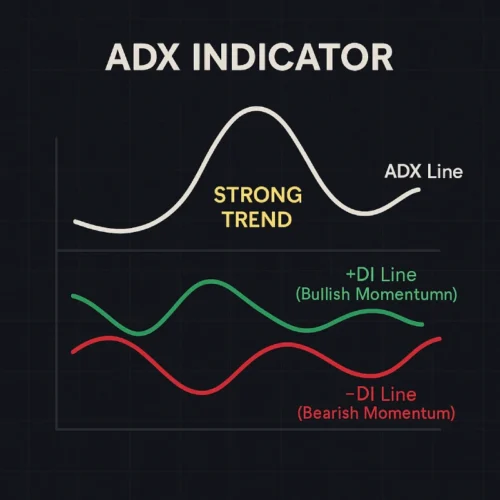

The ADX is a technical indicator that measures trend strength (not direction!) on a scale from 0 to 100. It’s part of Wilder’s Directional Movement System which includes:

- +DI (Positive Directional Indicator): Bullish momentum

- -DI (Negative Directional Indicator): Bearish momentum

- ADX (Average Directional Index): Trend strength regardless of direction

📌 Key Features:

- Works on all markets (stocks, forex, crypto)

- Best used on timeframes 1H or longer

- Combines beautifully with moving averages

Why Traders Swear By It:

✔ Filters out false breakouts

✔ Identifies when trends are likely to continue

✔ Works in all market conditions

🧮 How ADX is Calculated (Simplified)

While the full math is complex (involving True Range and Directional Movement), here’s what matters:

- +DI measures upward trend strength

- -DI measures downward trend strength

- ADX smooths and averages the difference between them

Standard Settings:

- 14 periods (adjustable)

- Values range 0-100

💡 Pro Tip: Don’t worry about the complex calculations – focus on interpreting the lines.

📊 How to Read and Use the ADX Indicator Like a Pro

ADX Value Interpretation:

| ADX Reading | Trend Strength | What It Means |

|---|---|---|

| 0-25 | Absent/Weak | Choppy market – avoid trend strategies |

| 25-50 | Strong | Ideal trending conditions |

| 50-75 | Very Strong | Extended trend (caution needed) |

| 75+ | Extreme | Often precedes reversals |

+DI/-DI Crossovers:

- +DI crosses above -DI: Potential bullish trend starting

- -DI crosses above +DI: Potential bearish trend starting

💼 3 Professional ADX Trading Strategies

1️⃣ The Trend Filter Strategy

- Only take long positions when ADX > 25 and +DI > -DI

- Only take short positions when ADX > 25 and -DI > +DI

2️⃣ The Breakout Confirmation Strategy

- Wait for price to break resistance

- Confirm with ADX rising above 20

- Enter if +DI is above -DI

- Filters out 70% of false breakouts

3️⃣ The Trend Exhaustion Play

- Watch for ADX > 50

- Wait for +DI/-DI to start converging

- Prepare for potential reversal

- Best combined with candlestick patterns

⏳ Best Timeframes & Markets

| Trading Style | Ideal Timeframe | ADX Settings |

|---|---|---|

| Day Trading | 1H-4H | 14-period default |

| Swing Trading | Daily | 14-period default |

| Crypto Trading | 4H+ | 21-period for less noise |

| Long-term Investing | Weekly | 10-period for sensitivity |

⚠️ Warning: ADX works poorly on timeframes under 30 minutes – the signals become unreliable.

⚠️ 5 Costly ADX Mistakes

❌ Trading ADX alone (Always combine with price action)

❌ Assuming high ADX = continuation (Could signal exhaustion)

❌ Ignoring DI crossovers (ADX shows strength, DIs show direction)

❌ Using default settings for crypto (Requires longer periods)

❌ Forgetting to adjust for volatility (During news events, ADX becomes unreliable)

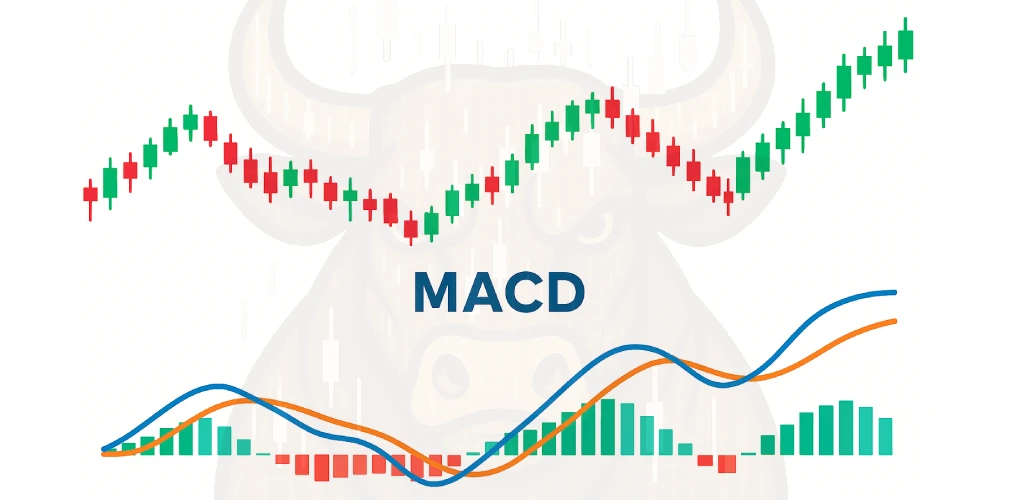

🔄 ADX vs Other Trend Indicators

| Indicator | Measures | ADX Advantage |

|---|---|---|

| MACD | Trend direction/momentum | ADX better for strength |

| Bollinger Bands | Volatility | ADX shows trend persistence |

| RSI | Momentum | ADX filters RSI signals |

💡 Smart Combo: ADX + EMA (200 period) + Volume = One of my favorite trend systems

❓ ADX FAQs

Start with 14-period. For crypto/volatile markets, try 21-period.

No – that’s what +DI/-DI lines are for. ADX only shows strength.

Some platforms use slight calculation variants. Stick to one platform.

Yes, but combine with implied volatility indicators.

Developed in 1978 – still used because trend behavior hasn’t changed.

📌 Key Takeaways

✔ ADX measures trend strength (0-100), not direction

✔ +DI/-DI show bullish/bearish momentum

✔ ADX > 25 suggests tradable trends

✔ Best combined with directional indicators

✔ Avoid in very choppy markets (ADX < 20)

🚀 Your Action Plan

- Today: Add ADX to your charts with +DI/-DI lines

- This Week: Practice identifying strong vs weak trends

- Next Month: Combine ADX with your favorite indicator

- Ongoing: Keep an ADX trading journal

This is the ADX guide I wish I had 4 years ago. Now go practice – your trading will never be the same! 📊🚀

Recommended Reading

Guide to Volume Price Analysis by Anna Coulling

Technical Analysis of the Financial Markets by John J. Murphy