🎓What Is DCA Strategy? The Complete 2025 Guide to Dollar-Cost Averaging

💡 Did you know that 78% of successful long-term investors use some form of DCA strategy? If you’ve ever wondered how to invest without trying to time the market or stress over daily price movements, dollar-cost averaging might be your perfect solution.

But what exactly is DCA, how does it work, and is it really better than lump sum investing? Whether you’re investing $50 or $50,000, this guide will break down everything you need to know about this powerful investment strategy.

📌 What Is Dollar-Cost Averaging (DCA)? (Simple Definition)

Dollar-cost averaging (DCA) is an investment strategy where you invest a fixed amount of money at regular intervals (weekly, monthly, etc.) regardless of market conditions. Instead of trying to time the market, you buy more shares when prices are low and fewer when prices are high, averaging out your cost over time.

🔹 Key Features of DCA

✅ Removes emotion from investing decisions

✅ Reduces risk of buying at market peaks

✅ Simplifies investing with automatic purchases

✅ Works with any amount (from $10 to $10,000+)

💡 Fun Fact: The term “dollar-cost averaging” was first coined in 1949 by economist Benjamin Graham in his book The Intelligent Investor!

🔄 How Does DCA Work? (Real Example)

Let’s say you invest $500 monthly in Bitcoin throughout 2024:

| Month | BTC Price | Your $500 Buys | BTC Acquired |

|---|---|---|---|

| January | $40,000 | $500 | 0.0125 BTC |

| February | $45,000 | $500 | 0.0111 BTC |

| March | $38,000 | $500 | 0.0132 BTC |

| April | $42,000 | $500 | 0.0119 BTC |

Result: You invested $2,000 total and acquired 0.0487 BTC at an average price of $41,068 (vs. timing the market perfectly).

⚠️ Remember: Some platforms charge fees that can reduce your DCA returns, especially for small, frequent purchases.

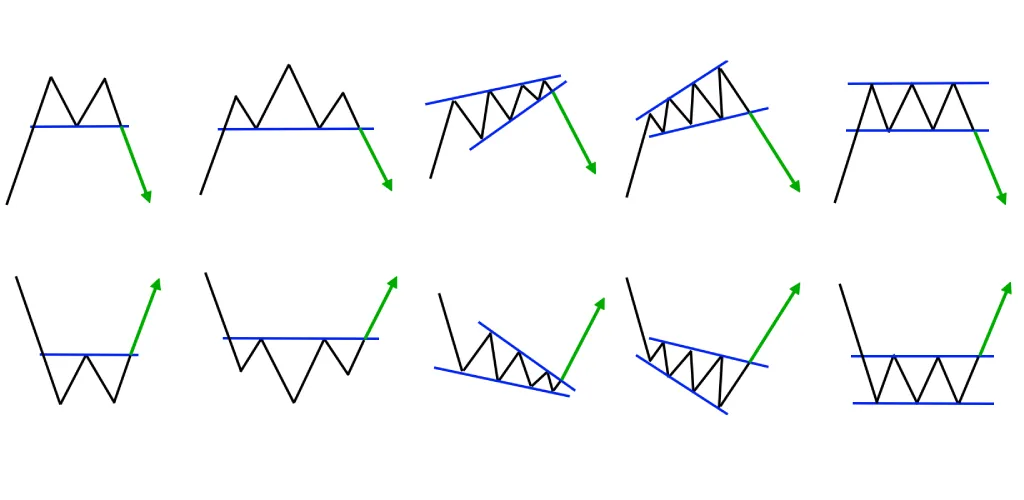

💰 DCA vs Lump Sum Investing

According to Vanguard research (2025 update):

- DCA outperforms lump sum investing in volatile markets

- Lump sum wins in 60% of cases during bull markets

- DCA reduces stress for beginner investors

📌 Best Approach: Use DCA if you’re risk-averse or investing a salary. Use lump sum if you have a windfall and can handle volatility.

🏆 Best Assets for DCA in 2025

| Asset | Why It Works | Recommended ETF |

|---|---|---|

| S&P 500 | Stable long-term growth | SPY or VOO |

| Bitcoin | High volatility = great DCA potential | BTC-USD |

| Tech Stocks | Strong sector growth | QQQ |

| REITs | Consistent dividends | VNQ |

⚠️ Avoid DCA on: Penny stocks, meme coins, and highly speculative assets.

📊 DCA Calculator: How Much Could You Earn?

Example: $300/month for 10 years in S&P 500 (historical 7% return)

| Year | Total Invested | Projected Value |

|---|---|---|

| 5 | $18,000 | $22,500 |

| 10 | $36,000 | $52,000 |

| 20 | $72,000 | $156,000 |

💡 Pro Tip: Most brokerages (Fidelity, Schwab) have free DCA calculators!

🚀 How to Start DCA (Step-by-Step)

- Choose Your Asset (ETF, crypto, or stock)

- Pick Your Amount ($50–$500+/month is common, 👉 Set it to what you can afford to invest)

- Set Up Automatic Investing (Use broker auto-invest tools), Or just remember to invest on a certain day of the month or week

- Stay Consistent (Don’t stop during market dips!)

- Rebalance Annually (Adjust if needed)

📌 Platforms That Automate DCA:

- Stocks: M1 Finance, Robinhood Recurring Investments

- Crypto: Coinbase Auto-Buy, Swan Bitcoin

📉 Psychological Benefits of DCA

Why it works for beginners:

- Eliminates FOMO (No panic buying tops)

- Reduces Regret (No blaming yourself for bad timing)

- Builds Discipline (Automation creates habits)

💡 2025 Investor Survey: DCA users check portfolios 63% less often than active traders!

🔮 Future of DCA (2025 Trends)

- AI-Powered DCA (Algorithms adjusting amounts based on market conditions)

- DeFi DCA Bots (Automated crypto DCA on Uniswap, Aave)

- Fractional Share DCA ($1/day investments becoming mainstream)

📌 Prediction: By 2030, 90% of retail investors will use some automated DCA strategy.

🎯 Final Verdict: Should You Use DCA?

✅ Yes if:

✔️ You’re a beginner investor

✔️ You invest from regular income

✔️ You want to reduce stress

❌ No if:

✖️ You have a large lump sum to invest

✖️ You’re an advanced trader with market timing skills

❓ FAQ: DCA Strategy

It reduces the risk of bad market timing by averaging your purchase price over time.

Yes, you keep buying at lower prices, setting up for gains when the market rebounds.

Yes, it works great for both, helping you build diversified exposure steadily.

Use platforms like Fidelity, Schwab, or M1 Finance to automate regular purchases.

If markets rise steadily, you may pay more over time; plus, small buys can have fees.

It’s excellent for volatile assets like crypto; for stocks, it depends on your strategy.

Start with 10–20% of your monthly disposable income and adjust as you grow.

No! Keep going — you’re buying more at cheaper prices, which boosts long-term gains.

📌 Quick Recap:

✔️ DCA = Invest fixed amounts regularly

✔️ Beats market timing for most investors

✔️ Works best for volatile assets

✔️ Automate it for maximum benefit

🚀 Now it’s your turn! Do you use DCA? Share your strategy below!