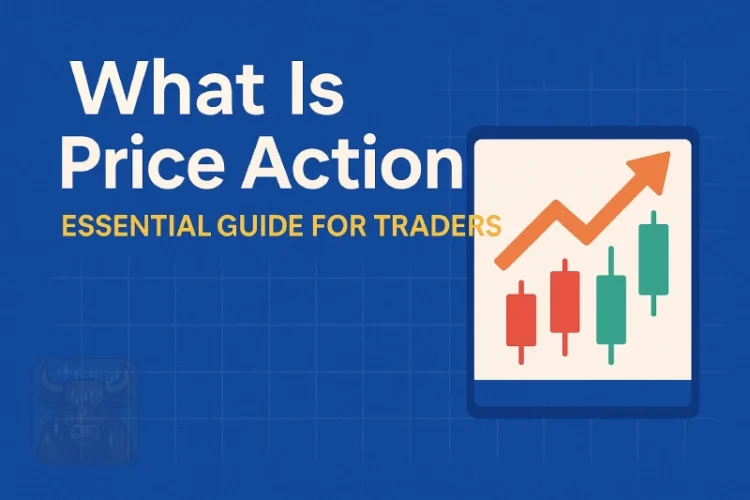

📊 What is Price Action? The Essential Trader’s Guide to Mastering Market Movement

Price Action trading is a powerful methodology that focuses on analyzing raw price movement without relying on complex indicators. Traders using this strategy study candlestick patterns, chart formations, and key support/resistance levels to make informed decisions. Whether you’re trading forex, stocks, or cryptocurrencies, understanding price action can significantly improve your trading performance.

👉 In simple terms: Price action is the art of “reading” the market by interpreting historical price behavior and how buyers and sellers interact.

📌 Key Characteristics of Price Action Trading

✅ Pure price focus: No RSI, MACD, or other lagging indicators—just price movement.

✅ Based on repetitive patterns: Markets have memory, and certain formations (like head and shoulders or double tops) repeat over time.

✅ Flexible strategy: Works across all markets (forex, stocks, crypto) and timeframes (scalping, swing trading, investing).

✅ Requires skill and interpretation: Unlike algorithmic trading, price action is discretionary and depends on trader experience.

🔄 How Price Action Trading Works

The core principle of price action is that “Price discounts all information”—meaning that news, emotions, and institutional orders are already reflected in the price. By studying price movement, traders can gauge market sentiment and predict future moves.

The Price Action Trading Process:

- Identify the trend: Is the market bullish, bearish, or ranging?

- Find key levels: Look for support/resistance zones, supply/demand areas, and Fibonacci retracements.

- Spot candlestick patterns: Recognize formations like Engulfing, Doji, Pin Bar, and Inside Bars.

- Define risk-controlled entries: Always set a stop loss and take profit based on price structure.

📊 Most Used Price Action Patterns (With Examples)

1️⃣ Key Candlestick Formations

- Pin Bar: A rejection candle with a long wick, signaling potential reversals.

- Engulfing Pattern: A bullish/bearish candle that “swallows” the previous one, indicating momentum shifts.

- Doji Candle: Shows indecision in the market, often preceding trend reversals.

2️⃣ Price Structures & Chart Patterns

- Support & Resistance: Key levels where price has historically reacted.

- Trend Channels & Wedges: Helps identify continuation or breakout opportunities.

- Triangles (Symmetrical, Ascending, Descending): Consolidation patterns that often lead to explosive breakouts.

3️⃣ Price Action in Trending Markets

- Pullbacks & Retracements: Temporary reversals within a trend, offering high-probability entries.

- False Breakouts: When price breaks a level but quickly reverses, trapping traders on the wrong side.

⚖️ Pros and Cons of Price Action Trading

✅ Advantages of Price Action Strategies

✔ Simplicity: No chart clutter from indicators—just pure price analysis.

✔ Versatility: Works for scalping, day trading, swing trading, and long-term investing.

✔ High accuracy in liquid markets: Forex majors, large-cap stocks, and major cryptocurrencies respond well to price action.

❌ Disadvantages of Price Action Trading

✖ Subjectivity: Different traders may interpret the same pattern differently.

✖ Requires experience: Not a “get-rich-quick” method—needs screen time and practice.

✖ Less effective in manipulated markets: Low-volume stocks or illiquid assets may produce false signals.

🔍 Is Price Action Trading Right for You?

✔ Ideal for traders who:

- Prefer a clean, indicator-free chart.

- Are patient and wait for high-probability setups.

- Understand that trading requires discipline and risk management.

✖ Not ideal for traders who:

- Want a fully automated trading system.

- Struggle with emotional control (price action requires patience).

- Trade low-liquidity assets prone to manipulation.

🛠️ Best Tools for Price Action Traders

- TradingView & MetaTrader: Clean charting platforms for pattern recognition.

- Heikin Ashi candles: Smoothes price action to identify trends easily.

- Volume Profile (for stocks/futures): Confirms breakout validity.

🎯 Final Thoughts: Mastering Price Action Trading

Price action isn’t just about “looking at candles”—it’s about understanding market psychology and making data-driven decisions. By mastering candlestick patterns, support/resistance levels, and trend analysis, you can develop a profitable trading strategy.

Want to improve your trading? Start by studying historical charts, backtesting strategies, and keeping a trading journal. Over time, price action trading can become one of your most reliable tools in the financial markets.

Recommended Reading

Guide to Volume Price Analysis by Anna Coulling

Technical Analysis of the Financial Markets by John J. Murphy