📈 What is Swing Trading? A Powerful Intermediate Strategy for Financial Markets

Discover what swing trading is, how it works, and why it’s perfect for part-time traders. Learn the top swing trading strategies, pros and cons, and how to get started today.

Swing Trading is a popular trading strategy that aims to capture short- to medium-term gains in a stock (or any financial instrument) over a period of several days to a few weeks. It sits right between day trading and long-term investing, making it an ideal approach for part-time traders or those looking for a more flexible style.

If you’re interested in trading without watching charts all day or committing to positions for months, swing trading might be the perfect balance.

📌 Key Features of Swing Trading

✅ Timeframe: Typically ranges from 3 days to a few weeks (sometimes up to a couple of months, depending on market conditions).

✅Trade Frequency: Moderate — a few trades per week or month, rather than daily trades like in scalping or day trading.

✅ Primary Analysis: A mix of technical analysis (chart patterns, indicators) and fundamental analysis (news, earnings reports, economic events).

✅Capital Requirements: Flexible — you can start swing trading with moderate capital and scale over time.

✅ Stress Level: Lower than day trading — no need to monitor the markets every minute.

🔄 How Does Swing Trading Work?

Swing traders seek to profit from short-term price movements, usually by buying at support levels (low prices) and selling at resistance levels (high prices). The goal is to capture “swings” within a larger trend.

Basic Process:

- Identify the trend: Determine if the market is bullish, bearish, or sideways.

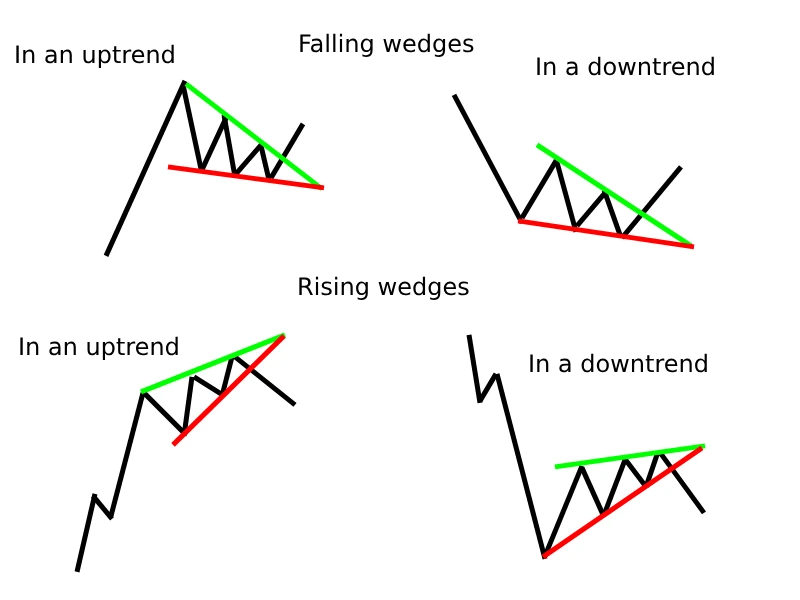

- Look for trade setups: Use tools like pullbacks, breakouts, and chart patterns.

- Enter the trade: Once confirmation occurs, open a position.

- Set a take-profit and stop-loss: Define clear risk/reward levels.

- Monitor the trade: Hold until the target is reached or market conditions change.

Swing trading doesn’t require constant screen time, but it does need regular check-ins to manage open positions.

📊 Common Swing Trading Strategies

There are several swing trading strategies that traders use to identify profitable opportunities. These include:

- Trend Following: Entering trades in the direction of the prevailing trend.

- Support and Resistance Bounces: Buying near support and selling near resistance.

- Breakout Trading: Trading price movements that break out of a consolidation range.

- Moving Average Crossovers: Using indicators like EMA 20 and EMA 50 to confirm entry/exit signals.

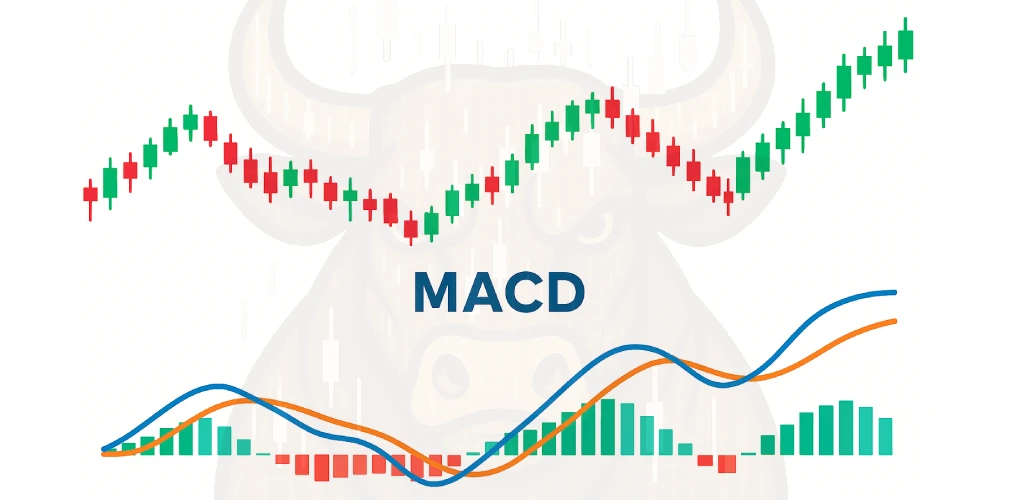

- Oscillators for Timing: Tools like RSI (Relative Strength Index) and MACD help confirm overbought or oversold conditions.

⚖️Pros and Cons of Swing Trading

Like any trading style, swing trading has its advantages and disadvantages.

✅ Pros:

✔️ Less time-consuming than day trading — ideal for people with full-time jobs.

✔️ Filters out short-term “market noise,” making analysis easier.

✔️ Higher profit potential per trade compared to intraday trading.

✔️ Flexible — you can trade stocks, forex, crypto, or ETFs.

❌ Cons:

❗ Overnight and weekend risk — prices may gap against your position.

❗ Not instant gratification — trades can take days or weeks to play out.

❗ Requires discipline and a solid trading plan — risk management is essential.

🔍 Is Swing Trading Right for You?

✔ Ideal if:

✔️ You want to trade part-time or alongside a full-time job.

✔️ You enjoy technical analysis and price action strategies.

✔️ You prefer a balance between active trading and long-term investing.

✖ Not recommended if:

✖️ You want quick profits every day — consider scalping or day trading instead.

✖️ You find it difficult to hold through temporary losses or volatility.

✖️ You struggle with following a strict plan and managing risk.

🎯 Conclusion: Why Swing Trading is a Top Choice for Intermediate Traders

Swing Trading is one of the most accessible and rewarding trading styles for those looking to grow their capital without the pressure of intraday decision-making. With the right strategies, solid technical analysis, and disciplined risk management, swing traders can consistently profit from market movements.

Whether you’re trading stocks, forex, or cryptocurrencies, learning how swing trading works can open up new opportunities for your financial journey.

Recommended Reading

Guide to Volume Price Analysis by Anna Coulling

Technical Analysis of the Financial Markets by John J. Murphy